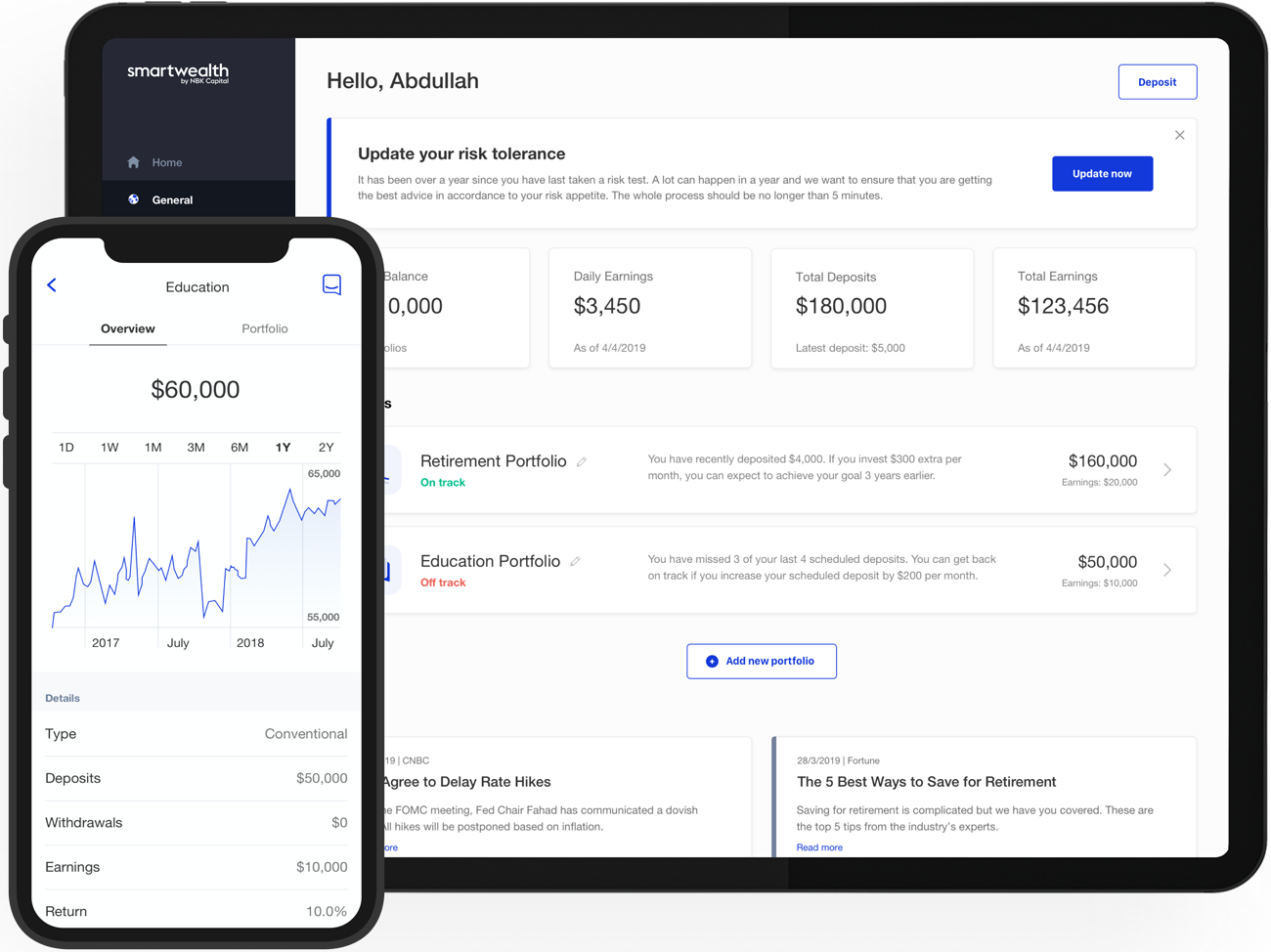

Establish your financial goals, we’ll help you achieve them

- Assessment of your risk tolerance

- Investments based on your goals

- Access to our investment professionals

Invest in a plan tailored to you and your family

- Stocks, bonds, and real estate exposure

- Conventional or Shariah-Compliant investing based on your preference

- Global, thematic, or regional investment options

See what your investments can do

Here's a projection of how your money can grow with SmartWealth versus a regular savings account.

SmartWealth growth is estimated at 4.8% return. Projected performance is used to illustrate the impact of lower fees and compounding and is not intended to show actual returns. Savings accounts are estimated at 0.5% return

SmartWealth Investment Account

Savings account

Invest in what matters to you

Select a product that matches your preference

Global, Multi Asset Investing

Long term passive investing in ETFs with Shariah Compliant options

Learn more

Thematic Investing

Investment based on different themes that matter to you (e.g. technology, ESG)

Learn more

NBK Capital Funds

NBK Capital Funds from Money Market Funds to Regional Investment Funds

Learn more

FAQ’s

Get all your questions answered, so you can effortlessly invest with big rewards sooner.

Who can open an account?

Anyone really, as long as you have a bank account with NBK, a valid Kuwaiti residency, and a Civil ID, thus available for Kuwaiti nationals and non-Kuwaitis. Upon submission of your application, we might ask for some additional information in case we require enhanced background checks.

If you are a non-NBK client, please reach out to us at support@nbkcapitalsmartwealth.com for assistance with opening a SmartWealth account.

If you are a non-NBK client, please reach out to us at support@nbkcapitalsmartwealth.com for assistance with opening a SmartWealth account.

What returns can I expect?

As your investments are capital markets based, we cannot guarantee any level of performance of the model portfolios we recommend (or that you will avoid a loss, total or partial). Any estimates we display rely on historic performance and are non-indicative of future performance.

How liquid are my funds after investing?

You can withdraw money (full or partial) from your SmartWealth account at anytime by submitting a request through web or app. Withdrawals are processed within 2 business days and 5 business days for redemptions back to your bank account. All applicable fees would be prorated, no penalties.